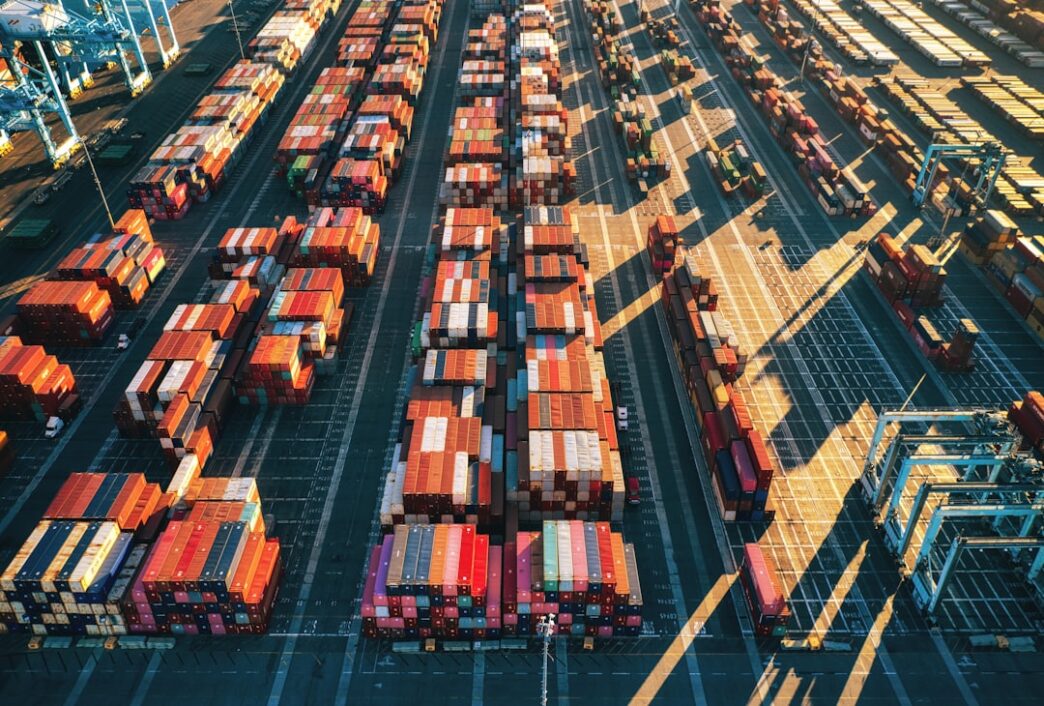

The COVID-19 pandemic served as a wake-up call for industries worldwide, highlighting the vulnerabilities inherent in global supply chains. As countries scrambled to secure essential goods, the cracks in a system overly reliant on just-in-time manufacturing became glaringly apparent. The result? A notable shift in how companies approach their supply chain strategies, signaling a new era of adaptability and resilience.

For instance, Toyota, a perennial leader in supply chain efficiency, faced production halts due to semiconductor shortages. This situation prompted the automotive giant to reassess its procurement strategies. Rather than concentrating sourcing efforts in a few countries, Toyota is now diversifying its supply chain, seeking out multiple suppliers across different regions, including both established and emerging markets. This restructuring allows the company to mitigate risks associated with geopolitical tensions and natural disasters, a lesson learned from the pandemic’s disruptions.

The U.S. government is also playing its part in encouraging this shift. Through the CHIPS Act, which aims to bolster domestic semiconductor manufacturing, the Biden administration is incentivizing companies to invest in local production capabilities. This policy not only addresses national security concerns but also positions the U.S. as a more competitive player in global technology supply chains. The initiative underscores a broader trend where nations are prioritizing local industries and reducing dependence on foreign sources.

A notable example of this trend is the European Union’s Green Deal, which seeks to transform various sectors, including manufacturing and transportation, towards sustainability. This policy is not just environmentally motivated; it represents an economic strategy to create a more robust internal market that can withstand external shocks. By investing in green technologies and renewable energy sources, the EU aims to establish a self-sufficient ecosystem that reduces vulnerabilities associated with importing fossil fuels and other critical materials.

Emerging markets stand to gain significantly from this global supply chain restructuring. Countries like Vietnam and India are already benefiting from manufacturers looking to shift operations away from China, spurred by rising labor costs and trade tensions. For instance, Apple has accelerated its plans to diversify production by increasing output in India and Vietnam, shifting some of its manufacturing away from China to reduce risk and enhance flexibility. These shifts not only bolster the economies of these nations but also play into a larger narrative of economic resilience.

However, this transition is not without challenges. The move to diversify supply chains can lead to increased complexity and higher costs. For example, companies may face difficulties in maintaining quality control across multiple suppliers and managing logistics more effectively. Furthermore, as firms rush to adapt, there is a risk of creating new bottlenecks in regions that may not yet be fully equipped to handle increased production demands.

Yet, the potential benefits outweigh these challenges. A more agile supply chain can respond more swiftly to market changes and consumer demands, fostering innovation and competitiveness. As businesses rethink their operational strategies, it becomes evident that a blend of localization and globalization may provide the optimal path forward. Multinational firms that can successfully navigate this complex landscape will likely emerge stronger, equipped with the resilience to withstand future disruptions.

The transformation of supply chains represents a pivotal moment in international trade, one that emphasizes the need for flexibility and foresight in a world increasingly defined by unpredictability. The lessons learned from recent disruptions will shape the future of global commerce, encouraging a more adaptive and strategic approach to international trade.