Tariffs are taxes imposed on imported goods, and they can significantly impact consumer prices in various ways. When a government raises tariffs on certain products, it usually leads to higher costs for those goods. Importers often pass these costs onto consumers, resulting in increased prices at retail outlets. For example, if a country imposes a 25% tariff on steel imports, manufacturers who rely on imported steel may increase their prices to cover the additional costs, which directly affects consumers purchasing products made with that steel.

The relationship between tariffs and consumer prices is influenced by several factors:

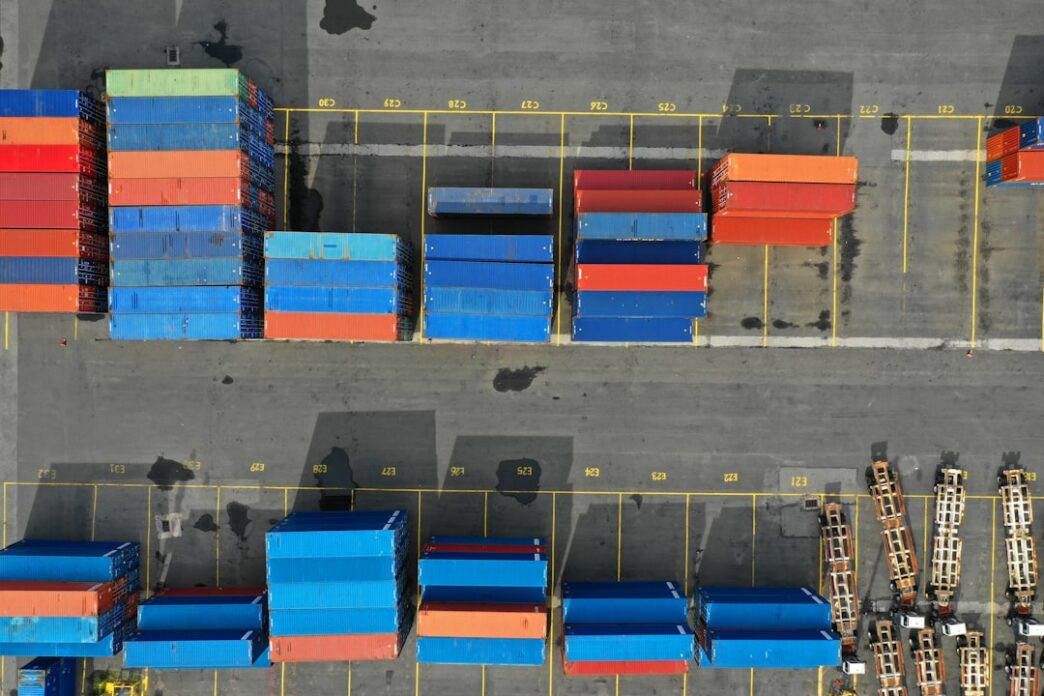

– **Supply Chain Dynamics:** Many industries depend on global supply chains. If tariffs raise costs on imported components, manufacturers may have to raise retail prices. For instance, the U.S.-China trade war led to increased tariffs on electronics, impacting the prices of popular items like smartphones and laptops.

– **Market Competition:** If the domestic market lacks competition, producers may raise prices even higher. Conversely, if there are multiple domestic players in the market, competition may mitigate price increases.

– **Consumer Behavior:** Higher prices can lead consumers to alter their purchasing decisions. For example, an increase in price due to tariffs might push consumers to seek cheaper alternatives or substitute goods, affecting demand for the more expensive products.

The impact of tariffs on prices can sometimes lead to unintended consequences. For instance, a country that raises tariffs on imports to protect domestic industries may find that it inadvertently stimulates inflation. When consumers face higher prices, they may adjust their spending habits, which can alter economic growth in the long term.

A recent example is the U.S. tariffs on Chinese imports enacted during the Trump administration. Studies estimated that these tariffs increased consumer prices by billions of dollars. Basic consumer goods, such as furniture, clothing, and electronics, saw sharp price hikes as companies adjusted to the new cost structure.

Additionally, the cumulative effect of multiple tariffs can lead to inflationary pressures throughout the economy. If consumers are spending more on basic goods, they may have less disposable income for other purchases, affecting overall economic growth.

In summary, tariffs can lead to higher consumer prices by directly raising the costs of imported goods and disrupting established supply chains. The ripple effect on the economy can lead to inflation and alter consumer behavior, complicating the economic landscape. As governments consider trade policies, the implications for consumer prices remain a critical factor to assess.