As the rapid advancement of automation and artificial intelligence reshapes the labor market, companies are increasingly confronted with the challenge of redefining worker benefits. This evolution is particularly crucial for gig economy workers, who often lack the protections and perks that traditional employees enjoy. In response, various organizations and policymakers are exploring innovative benefit models that could serve as a template for the future of work.

Take the case of Upwork, a prominent platform connecting freelancers with clients. Recognizing the potential for a vast number of its users to remain unprotected, Upwork has begun advocating for a new form of portable benefits. This would allow freelancers to accumulate benefits such as health insurance, retirement savings, and paid leave, which are traditionally tethered to full-time employment. The model suggests that benefits should follow workers regardless of their employment status, promoting both security and flexibility.

In a parallel development, the U.S. labor market is seeing movements toward legislative reform that addresses the needs of non-traditional workers. For instance, California’s AB 5 law, which aimed to classify many gig workers as employees rather than independent contractors, sparked nationwide discussions. Advocates argued that this shift was essential to ensure that workers received benefits like unemployment insurance and workers’ compensation. However, pushback from companies like Uber and Lyft, which rely heavily on gig labor, led to ballot initiatives that allowed these companies to create their own benefit frameworks while maintaining the independent contractor status of their workers.

Countries outside the U.S. are also experimenting with benefit systems that take automation into account. For example, the Netherlands has proposed an initiative called “The Future of Work,” which emphasizes flexibility in benefit schemes. This initiative aims to create a social safety net that adapts to the gig economy while ensuring that workers can still access vital services. The model is designed to be inclusive, reaching not only traditional employees but also those who engage in freelance or contract work.

The integration of technology into the benefits landscape is evident in platforms like Benefits by SimplyInsured, which provide small businesses with affordable health insurance options. These services exemplify how tech can not only streamline administration but also make it easier for smaller firms to offer competitive benefits, thereby leveling the playing field in a landscape where automation often sidelines smaller players.

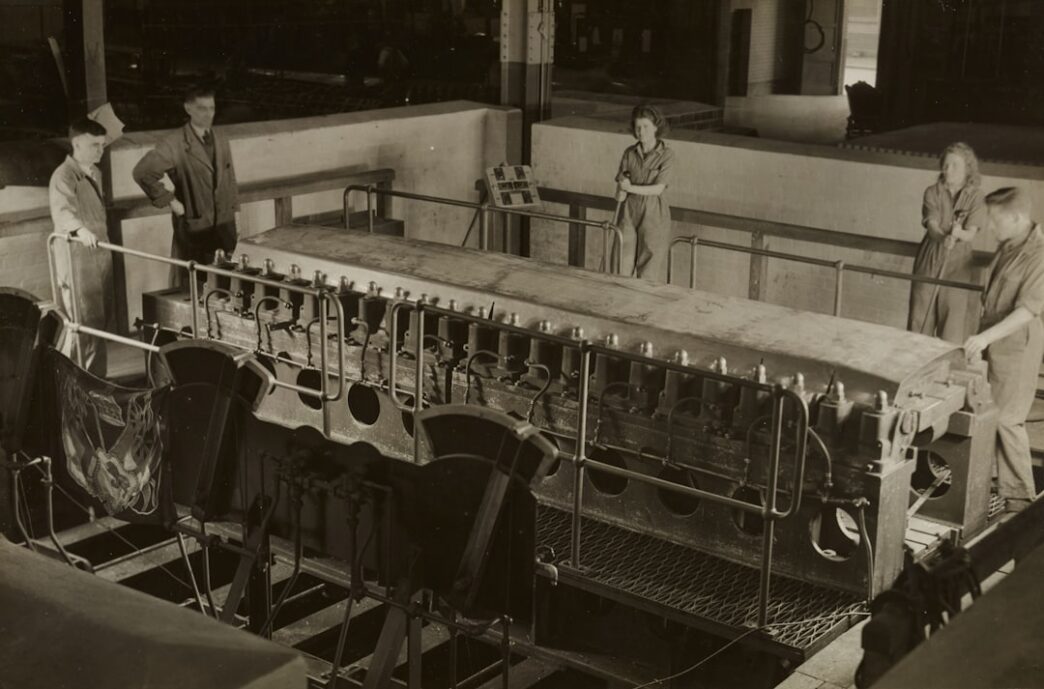

However, the transition to a more inclusive benefits framework faces obstacles. Many companies still adhere to outdated models that prioritize cost-cutting over comprehensive employee support. Additionally, the complexity of navigating different employment classifications can discourage innovation. Workers in sectors heavily influenced by automation, such as manufacturing and logistics, often find themselves in precarious positions where benefits are inconsistent or entirely absent.

As the labor market continues to evolve, the conversation around worker benefits must shift from traditional employer-employee dynamics to a more fluid understanding that encompasses a variety of work arrangements. Policymakers, businesses, and workers alike have a stake in this progression, as the implications of these changes will resonate across economic sectors and societal structures.

The need for a collaborative approach is more pressing than ever, as technology continues to advance at breakneck speed. If left unaddressed, the lack of sufficient worker benefits could exacerbate economic inequalities, privileging those with stable jobs while marginalizing gig workers. The challenge lies in crafting policies and systems that not only respond to the current landscape but also anticipate the needs of a workforce increasingly characterized by diversity and flexibility.